Invoice vs. Bill: Understanding the Key Differences

Key Takeaways

- An invoice is a document sent by a seller to request payment

- A bill is a document received by a buyer indicating an amount owed

- Invoices are typically more detailed than bills

- Understanding these differences is crucial for proper accounting and financial management

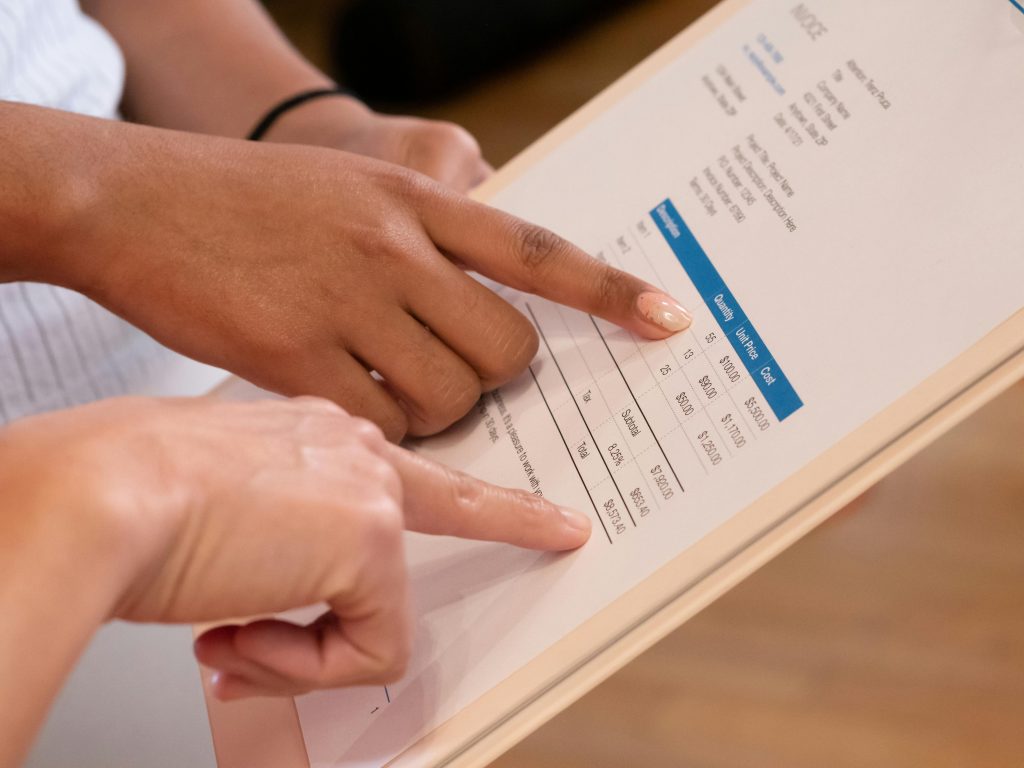

What is an Invoice?

An invoice is a commercial document issued by a seller to a buyer. It serves as a formal request for payment and typically includes:

- A unique invoice number

- Itemized list of goods or services provided

- Quantities and prices

- Total amount due

- Payment terms and due date

Invoices play a crucial role in accounting, serving as a record of sale for the seller and a purchase record for the buyer.

What is a Bill?

A bill, on the other hand, is a document that a buyer receives, indicating an amount owed for goods or services. While similar to an invoice, a bill is often less detailed and more focused on the total amount due. Bills are commonly used for recurring payments like utilities or rent.

Invoice vs. Bill: Key Differences

- Perspective: An invoice is sent by the seller, while a bill is received by the buyer.

- Detail: Invoices typically contain more detailed information about the transaction.

- Timing: Invoices are often sent before payment is due, while bills may be sent after services are rendered.

- Usage: Invoices are more common in business-to-business transactions, while bills are often used for consumer services.

Related Concepts

Understanding the invoice vs. bill difference is just the beginning. Here are some related terms you should know:

- Statement: A summary of transactions over a period, often including multiple invoices or bills.

- Receipt: A document confirming that payment has been received.

- Purchase Order: A document sent by a buyer to a seller, indicating types, quantities, and prices for products or services.

Invoicing vs. Billing: Process Differences

The invoicing process typically involves:

- Creating and sending detailed invoices

- Tracking unpaid invoices

- Following up on overdue payments

The billing process often includes:

- Generating bills for services rendered or goods delivered

- Sending reminders for payment

- Processing payments received

Importance in Accounting

In accounting, invoices and bills serve different purposes:

- Invoices are recorded as accounts receivable for the seller and accounts payable for the buyer.

- Bills are typically recorded as expenses or liabilities by the receiver.

Understanding these distinctions is crucial for maintaining accurate financial records and managing cash flow effectively.

Managing Invoices and Bills with Linbis

Modern businesses need efficient systems to manage both invoices and bills. This is where Linbis comes in. Linbis offers a comprehensive solution that streamlines your entire financial process:

- Easy Invoice Creation: Generate professional invoices quickly and easily.

- Bill Management: Keep track of bills you owe, ensuring timely payments.

- Automated Reminders: Set up automatic reminders for unpaid invoices and upcoming bills.

- Integration: Connect your invoicing and billing processes with other aspects of your business, like inventory and customer management.

- Reporting: Gain insights into your cash flow with detailed reports on both incoming payments and outgoing expenses .

- Multi-Currency Support: Manage international transactions with ease.

- Cloud-Based Access: Access your financial data anytime, anywhere.

By using Linbis, you can efficiently manage both sides of your financial transactions, whether you’re sending invoices.

Best Practices for Invoice and Bill Management

- Be consistent with your terminology to avoid confusion

- Keep detailed records of all invoices and bills

- Set clear payment terms on your invoices

- Pay your bills on time to maintain good relationships with suppliers

- Regularly reconcile your invoices and bills with your bank statements

- Use digital tools like Linbis to automate and streamline your processes

Conclusion: Streamlining Your Financial Processes

Understanding the difference between invoices and bills is crucial for effective financial management. While they serve similar purposes, their subtle distinctions can have significant implications for your accounting practices.

By leveraging modern tools like Linbis, you can streamline both your invoicing and billing processes, ensuring accuracy, timeliness, and efficiency. Whether you’re a small business owner, freelancer, or financial manager in a large corporation, having a clear grasp of these concepts and the right tools at your disposal will set you up for financial success.

Ready to revolutionize your invoice management? Explore how Linbis can transform your financial processes today!