Overview of AES Filing Requirements

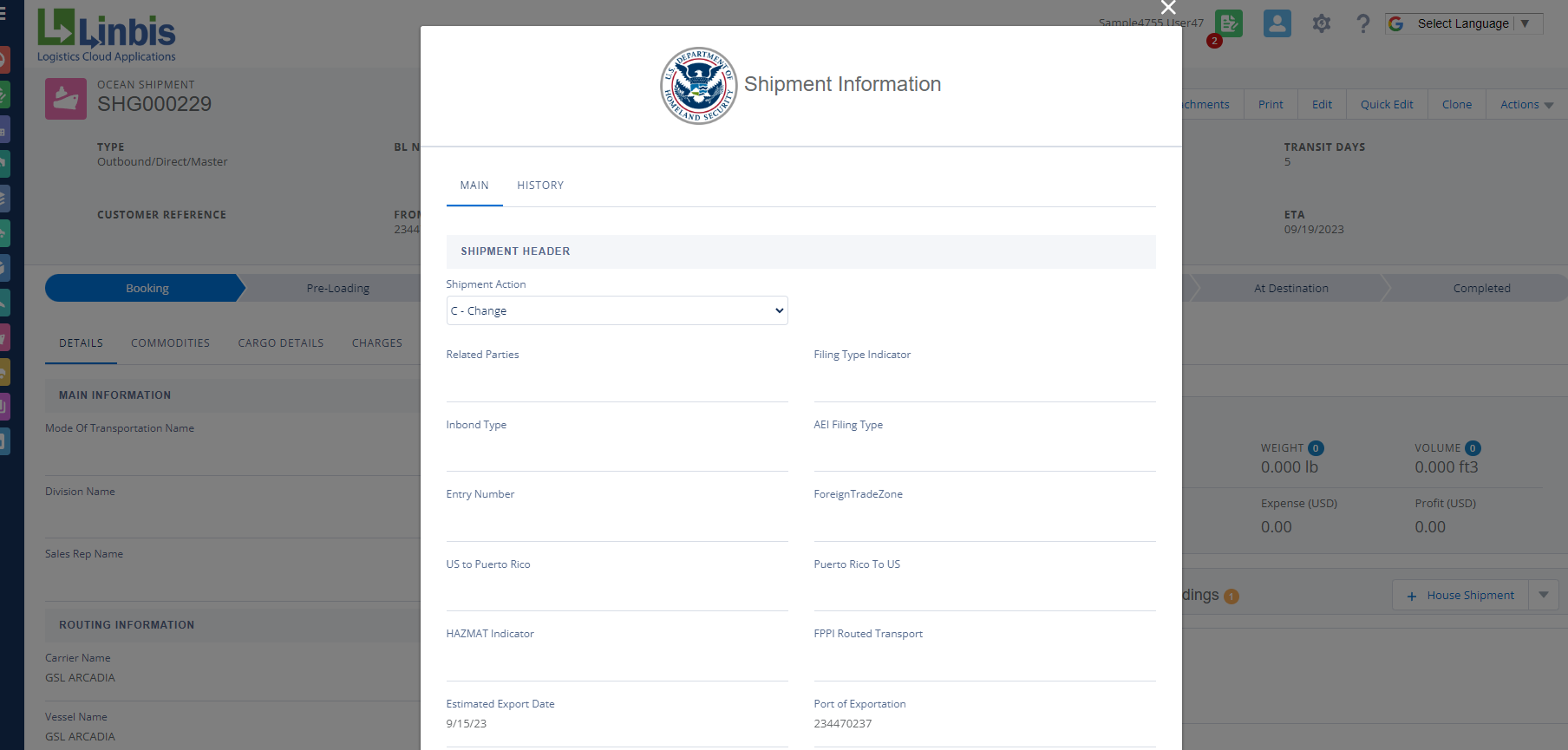

Step-by-Step Guide to AES Filing

How to File Correctly

Mandatory Filing Criteria: AES filing is required for shipments valued over $2,500 per Schedule B or Harmonized Tariff Schedule (HTS) number and for shipments requiring an export license. Exemptions: Certain shipments, such as low-value shipments and specific types of exports (e.g., U.S. government shipments), may be exempt from filing.

Exporter Information: Name, address, and Employer Identification Number (EIN) of the U.S. Principal Party in Interest (USPPI). Consignee Information: Name and address of the foreign recipient. Description of Goods: Detailed description of the goods, including the Schedule B or HTS number, quantity, value, and weight. Transportation Details: Mode of transport, carrier, and port of export. License Information: Export license number or license exception code if applicable.

AESDirect Portal: Exporters can file their EEI through the AESDirect portal, an online platform provided by the U.S. Census Bureau.

Third-Party Filing: Exporters may use authorized agents or freight forwarders to file on their behalf.

Internal Transaction Number (ITN): Receive the ITN upon successful filing. This number must be included in the export documentation.

Record-Keeping: Keep detailed records of all filed EEI, including the ITN and copies of the submitted information, for a minimum of five years.

Common Pitfalls in AES Filing

Avoiding Mistakes

Misclassifying goods under the wrong Schedule B or HTS number can lead to errors in the filing process.

Omitting required details such as the export license number or consignee information can result in filing rejections.

Submitting EEI after the shipment has departed can lead to penalties and delays in processing.

Resources for AES Filing Assistance

Where to Get Help

The official AES website provides guidelines, FAQs, and user manuals for filing EEI.

The AESDirect portal offers resources and support for exporters filing their EEI online.

Various organizations offer training programs and workshops on export compliance and AES filing.

Export compliance consultants can provide personalized assistance and ensure that your filings are accurate and compliant with regulations.

FAQs about AES Filing Requirements

Answers to Common Questions

- What is AES filing?

- AES filing is the process of submitting electronic export information (EEI) through the Automated Export System (AES) for goods exported from the United States.

- When is AES filing required?

- AES filing is required for shipments valued over $2,500 per Schedule B or HTS number and for shipments requiring an export license.

- How do I file through AESDirect?

- You can file through AESDirect by accessing the online portal provided by the U.S. Census Bureau and submitting the required EEI.

- What information is needed for AES filing?

- Required information includes exporter and consignee details, description of goods, transportation information, and export license details if applicable.

- What happens if I don’t file AES?

- Failure to file AES when required can result in penalties, including fines and delays in shipment processing.

Conclusion

Summary and Final Thoughts

Complying with AES filing requirements is essential for ensuring smooth and legal export operations. By understanding when and how to file through AES, gathering the necessary information, and avoiding common pitfalls, exporters can ensure compliance and avoid penalties. Proper AES filing supports efficient export processes and helps maintain accurate trade statistics and regulatory enforcement. For more information visit census