Demystifying DDP Incoterms for Professionals

What is DDP Incoterms?

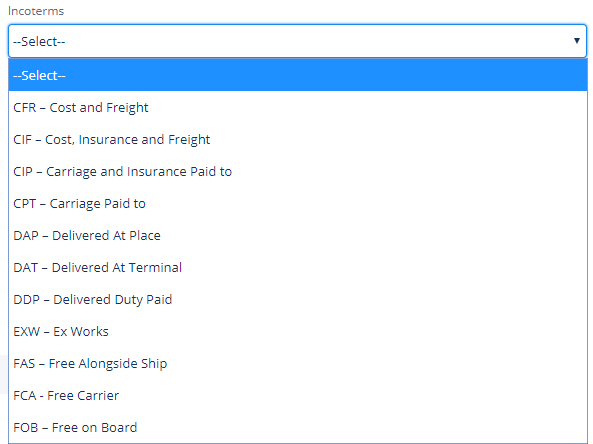

Delivered Duty Paid (DDP) is one of the 11 Incoterms defined by the International Chamber of Commerce (ICC). It represents a term in which the seller assumes responsibility for delivering goods to a designated destination, with all costs covered, including shipping, taxes, customs duties, and any other charges that may arise during the transport process.

Key Aspects of DDP:

- Seller’s Responsibility: The seller is responsible for all costs involved in the transportation of goods, including freight, insurance, import duties, and taxes.

- Buyer’s Responsibility: The buyer’s only responsibility is to receive the goods at the agreed-upon destination.

- Delivery Location: The seller delivers the goods when they are placed at the disposal of the buyer, ready for unloading at the agreed destination.

- Customs and Duties: Under DDP, the seller handles all aspects of customs clearance and payment of import duties, ensuring that the buyer doesn’t need to worry about these processes.

Key Features of DDP Incoterms

- Comprehensive Delivery:

DDP is one of the most comprehensive Incoterms for sellers, as it requires them to handle the entire logistics process, including all transportation and customs processes. This contrasts with other terms where the seller’s responsibility ends at a certain point in the transit process. - Customs and Duties Handling:

The seller is responsible for handling both export and import customs clearance. This includes ensuring that the correct tariffs are paid and that all relevant documents are filed with the customs authorities. - Risk and Responsibility:

The seller bears all risks and responsibilities until the goods are delivered to the final destination. This includes managing unforeseen costs, handling delays, or any issues with customs clearance. - Cost Implications:

DDP tends to be more expensive for sellers as they are responsible for covering all logistics costs. However, it simplifies the process for the buyer, making it a preferred term for certain businesses looking to ensure a seamless and hassle-free delivery.

Practical Uses of DDP Incoterms for Businesses

- For Sellers

DDP Incoterms are advantageous for sellers who wish to offer a comprehensive and customer-friendly service. By choosing DDP, sellers simplify the buying process for their customers, offering a door-to-door service where the buyer is not required to handle any of the logistics or customs complexities.

Example: A European manufacturer of machinery selling to a business in the United States might choose DDP to ensure the buyer only needs to focus on receiving the goods, with no additional steps involved. - For Buyers

Buyers benefit from DDP because it minimizes their responsibilities and reduces the potential for unexpected costs. With DDP, they know exactly what the final price will be, including all shipping, duties, and taxes. This predictability is a significant advantage, especially for businesses involved in e-commerce or retail, where unexpected costs could negatively impact margins.

Example: A retailer importing electronics from Asia would prefer DDP terms, as the seller would take care of all import duties and customs processes, ensuring that the goods arrive at the store with minimal delay and at the agreed-upon cost. - For Freight Forwarders

Freight forwarders play a key role in coordinating logistics and ensuring compliance with customs regulations. DDP requires freight forwarders to work closely with both sellers and buyers to manage the entire shipping process and ensure that all documentation, tariffs, and duties are handled efficiently. - For Supply Chain Managers

Supply chain managers dealing with international shipments can use DDP to simplify their import and export processes. Since the seller is responsible for the full delivery process, supply chain managers don’t have to worry about the complexities of international shipping, making it easier to plan and track shipments.

Advantages of Using DDP Incoterms

- Simplicity for the Buyer

One of the primary benefits of DDP is that the buyer faces no complexities in the shipping and customs process. Since the seller assumes full responsibility, the buyer can focus solely on receiving the goods. - Predictability of Costs

Since the seller covers all costs involved in the shipment, buyers know exactly how much they will pay for the goods, including shipping and taxes. This makes it easier for businesses to budget and plan for their inventory. - Streamlined Operations

For businesses that want to streamline their operations, DDP can simplify the shipping and importation process. It eliminates the need for buyers to coordinate with customs brokers, insurance companies, or freight carriers, as all of these tasks are handled by the seller. - Customer Satisfaction

DDP offers a high level of customer satisfaction because it removes any hassle or complexity for the buyer. The seller handles all aspects of the delivery, ensuring that the buyer receives their goods promptly without worrying about any potential customs issues.

Challenges of DDP Incoterms

- Higher Costs for the Seller

Sellers taking on the full responsibility of the shipment will incur higher costs, as they need to account for customs clearance, duties, and other shipping-related charges. This can make DDP an expensive option, particularly for long-distance or complex shipments. - Customs and Legal Compliance

Managing the customs process in the buyer’s country can be complicated. Sellers need to be familiar with the import regulations, tariffs, and customs procedures of the destination country, which can vary greatly. This can add time and complexity to the process. - Risk Management

As the seller assumes all risks until the goods are delivered, any issues with customs delays, fines, or damages to the goods are the responsibility of the seller. This can increase the seller’s risk exposure and lead to financial losses if something goes wrong during the delivery process.

Best Practices for Managing DDP Incoterms

- Thorough Documentation

Sellers must ensure that all required documents—such as commercial invoices, customs declarations, and packing lists—are correctly completed and submitted to customs authorities to avoid delays. - Understanding Tariffs and Duties

Sellers must stay up to date with the latest tariff codes, taxes, and customs regulations for the destination country. This is crucial to avoid mistakes in classification and ensure the correct amount of duty is paid. - Reliable Freight Forwarders

To manage DDP efficiently, businesses should work with experienced freight forwarders who are familiar with international trade regulations and can manage the complexities of the customs clearance process. - Clear Communication with Buyers

Clear communication is essential to ensure both parties understand their responsibilities. Sellers should provide buyers with accurate delivery timelines and detailed cost breakdowns to avoid confusion.

Conclusion

Delivered Duty Paid (DDP) Incoterms are a valuable tool for businesses engaged in international trade, offering simplicity and predictability for buyers. While DDP terms place a higher burden on sellers, they also provide a competitive advantage by offering a seamless and hassle-free experience for buyers. By understanding the key features, advantages, and challenges of DDP, professionals can make more informed decisions when negotiating international contracts, ensuring smoother operations and stronger business relationships.