DDU Incoterms: The Complete Guide to Delivery Duty Unpaid

What are DDU Incoterms?

DDU Incoterms, or Delivered Duty Unpaid, is a shipping term that was part of the Incoterms (International Commercial Terms) up until 2010. Although it has been officially replaced by DAP (Delivered at Place) in the Incoterms 2010 and 2020 editions, many businesses still use and refer to DDU in their shipping agreements.

Key Aspects of DDU Incoterms:

- The seller is responsible for delivering the goods to the named place in the country of importation.

- The seller bears all risks and costs associated with bringing the goods to the destination, excluding duties, taxes, and other official charges payable upon importation.

- The buyer is responsible for paying import duties, taxes, and other official charges.

- The buyer also bears the risk and costs of carrying out customs formalities.

DDU Meaning in Shipping

In the context of shipping, DDU means that the seller is responsible for:

- Arranging transportation to the agreed destination

- Bearing all costs and risks until the goods are ready for unloading at the destination

- Providing export documentation

The buyer, on the other hand, is responsible for:

- Unloading the goods at the destination

- Clearing the goods through customs

- Paying import duties, taxes, and other official charges

DDU vs. Other Incoterms

To better understand DDU Incoterms, it’s helpful to compare them with other similar terms:

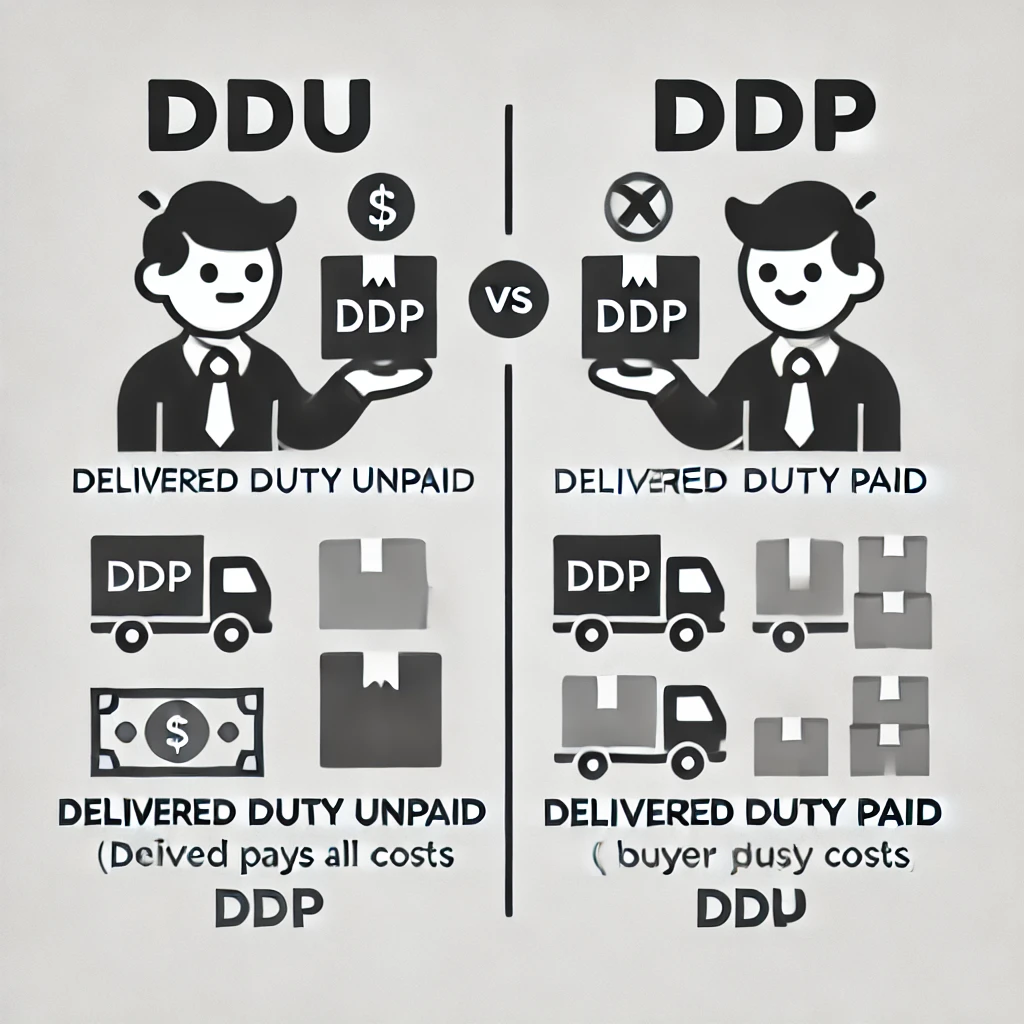

DDU vs. DDP (Delivered Duty Paid)

The main difference between DDU and DDP lies in who is responsible for paying import duties and taxes:

- In DDU, the buyer pays these charges.

- In DDP, the seller is responsible for all costs, including import duties and taxes.

DDU vs. DAP (Delivered at Place)

DAP is the term that replaced DDU in the Incoterms 2010 revision:

- DAP is essentially the same as DDU, with the seller responsible for delivery to the named place, excluding import duties and taxes.

- The main difference is in terminology and some minor clarifications in the responsibilities.

DDU vs. CIF (Cost, Insurance, and Freight)

- In CIF, the seller’s responsibility ends when the goods are loaded onto the ship at the port of origin.

- In DDU, the seller’s responsibility extends to the delivery at the named place in the destination country.

Advantages and Disadvantages of DDU Incoterms

Advantages:

- Clarity in cost division between buyer and seller

- Seller maintains control over transportation

- Buyer can leverage local knowledge for customs clearance

Disadvantages:

- Potential for delays if the buyer is not prepared for customs clearance

- Risk of additional costs for the buyer if import duties are higher than expected

- Complexity in coordinating the handover at the destination

DDU Shipping: Practical Considerations

When dealing with DDU shipping, several practical aspects need to be considered:

- Documentation: Ensure all necessary export documents are prepared accurately.

- Insurance: While not mandatory, it’s advisable for the seller to insure the goods until delivery.

- Customs Broker: The buyer may need to engage a customs broker to handle import formalities.

- Delivery Confirmation: Establish clear procedures for confirming successful delivery.

DDU Terms: Key Responsibilities

Understanding the specific responsibilities under DDU terms is crucial:

Seller’s Responsibilities:

- Provide the goods and commercial invoice

- Obtain export license and carry out export formalities

- Contract for carriage to the named place of destination

- Provide delivery notice to the buyer

- Bear all risks until the goods are ready for unloading at the destination

Buyer’s Responsibilities:

- Pay the price as provided in the contract of sale

- Obtain import license and carry out import formalities

- Take delivery of the goods at the named place

- Bear all risks from the time the goods are ready for unloading

- Pay all import duties, taxes, and other official charges

DDU Incoterms Meaning: Common Misconceptions

There are several misconceptions about DDU Incoterms that are important to clarify:

- DDU is still an official Incoterm: While widely used, DDU was officially replaced by DAP in 2010.

- The seller is responsible for unloading: Under DDU terms, unloading is the buyer’s responsibility.

- DDU covers all costs: Import duties and taxes are excluded from the seller’s responsibilities.

DDU Delivery: Challenges and Solutions

Implementing DDU delivery can present some challenges:

- Customs Delays: The buyer should be prepared to handle customs clearance efficiently.

- Cost Uncertainty: Import duties and taxes can vary, creating uncertainty for the buyer.

- Coordination: Smooth handover at the destination requires good communication between parties.

Solutions to these challenges include:

- Engaging experienced customs brokers

- Researching potential import charges in advance

- Establishing clear communication protocols between buyer and seller

DDU in Different Countries

The application of DDU (or its replacement, DAP) can vary in different countries:

United States

- Customs procedures are generally straightforward but can be complex for certain goods.

- The Automated Broker Interface (ABI) system facilitates electronic submission of customs information.

European Union

- The Union Customs Code (UCC) provides a common framework for customs procedures.

- VAT regulations can complicate DDU shipments within the EU.

China

- Customs clearance can be more complex and time-consuming.

- Certain goods may require special import licenses or certificates.

Technology and DDU Incoterms

Advancements in technology are impacting how DDU shipments are managed:

- Track and Trace Systems: Allow real-time monitoring of shipments.

- Electronic Documentation: Facilitates faster processing of shipping documents.

- Blockchain: Some companies are exploring blockchain for more secure and efficient international transactions.

- AI and Machine Learning: Help in predicting potential customs issues and optimizing shipping routes.

DDU Incoterms 2020: What's Changed?

Although DDU is no longer an official Incoterm, it’s important to understand how its replacement, DAP, is treated in Incoterms 2020:

- Clarification on security-related requirements

- More detailed cost allocation

- Inclusion of own transport by the seller as an option

Best Practices for DDU Shipping

To ensure smooth DDU shipments:

- Clearly define the exact delivery point in the contract

- Provide detailed and accurate documentation

- Communicate regularly with the buyer about the shipment status

- Consider insurance coverage for the entire journey

- Be prepared for potential customs challenges

The Future of DDU and International Trade

While DDU has been replaced by DAP, the concept it represents remains crucial in international trade. Looking ahead:

- Increased digitalization of trade documentation

- Greater emphasis on sustainability in shipping practices

- Potential for more harmonized customs procedures globally

- Continued evolution of Incoterms to reflect changing trade practices

Conclusion: Mastering DDU Incoterms for Effective Global Trade

Understanding DDU Incoterms (and its current equivalent, DAP) is crucial for anyone involved in international trade. By clearly defining the responsibilities of buyers and sellers, these terms help facilitate smooth transactions and reduce the potential for disputes.

Whether you’re new to international shipping or a seasoned trader, a thorough understanding of DDU and how it compares to other Incoterms will help you make informed decisions about your international transactions. Remember, while DDU offers many advantages, it’s essential to consider your specific situation and consult with logistics experts to determine if DDU (or DAP) is the most appropriate Incoterm for your needs.

By mastering DDU Incoterms and staying informed about the latest developments in international shipping terms, you’ll be better equipped to navigate the complexities of global trade, minimize risks, and build strong, efficient international business relationships.